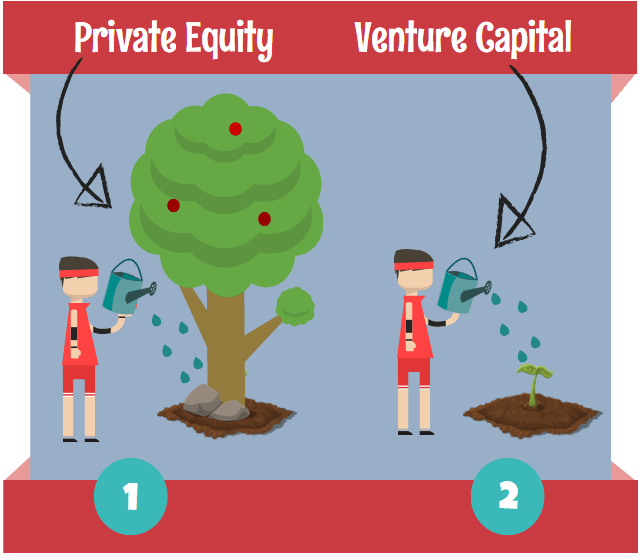

Private equity and Venture capital firms invest in companies and exit by selling their investments. Yet, they are entirely different in conducting business. The private equity industry invests capital in a company. The companies are generally not listed publicly or traded. On the contrary, venture capital funds for startups and other young businesses exhibit greater potential toward long-term growth.

So, as the target is entirely different the investment principles vary from one another. The mindset behind the investment goals and achievements also changes accordingly. Technically speaking, venture capital is the subset of private equity.

As said earlier, the way PEs and VCs get involved with companies is entirely different. PE uses debt and equity while VCs use the equity in most of the cases and rarely debt. PE investments occur in hundreds of millions of dollars (even billions) whereas VCs make smaller and incremental investments over a span of time.

Let’s understand the private equity markets and Venture capital firms in detail here.

Diversification

PE firms are restrained whereas VC firms are deliberate in diversification.

Since VCs choose startups or young companies, only a handful of transactions will turn successful. In VCs words, luck is the driver here. However, it matters in the early years of a fund’s life, and as the company grows, they systematically and methodically put their capital and disregard the majority of their holdings. VCs are short term players like the LBO fund managers.

Let’s talk about diversification in PE firms. The PE fund managers may not diversify as much as the VC counterparts because they manage a portfolio asset through contractual terms or ownership. Also, they can take resolute decisions in absence of co-investors. Needless to say, their targets are mature companies that generally will not face business and market uncertainty. Therefore, the failure rate is lower as compared to VC firms.

Risk and reward

The life cycle of PE firms and VCs divide them apart. VCs raise funds, invest that money in several companies [with less amount], and look for thousands of deals in a year. Their investment number is more. of these, a few will fail, some will break, some might do well, and a few may bring good returns. So, the returns are not as expected or more profitable as their PE counterpart.

On the contrary, PE funds operate in a highly structured way by investing in a select company, improving it, and selling it off for a profitable price after the holding period.

Performance behavior

VCs shed their least-performers very early in the life of a fund investment period. Immediately after the first four years of a ten long year fund, they may not spend much capital on the underperforming companies.

It is exactly the opposite way in PE firms. PE owners hold on for as long as possible than getting cut-off from their portfolio companies. The longer the portfolio company is held, they will get time to restructure, refinance, and overcome economic downturns or temporary setbacks. Also, they get management fees as long as they hold the company.

To summarize…

PE firms and VC firms follow a 2-pronged investment strategy when optimizing their holding periods and diversification. The performance improvement techniques are different and precisely opposite to each other.

The companies they buy are different, sizes are different, investment amounts are different, and claiming of percentages in equity are different. Though both the firms invest money, the strategy, mindset, and objectives are different altogether. PE firms buy companies from any industry while VCs tend to buy companies involved in technology, biotechnology, and clean technology. Still, as we find exceptions for every rule, we may find exceptions here too. They may act out of norms in special cases.